Data-Driven Fixes

Reducing Preventable Participant Errors with Data

How behavioral analysis helped improve benefits education and reduce costly mistakes

Benefits plans are only as effective as the participants’ ability to use them. When participants don’t understand their plans, it doesn’t just impact them; it creates a ripple effect of support tickets, lost funds, and missed compliance opportunities.

In this post, I’ll walk through how I used data to uncover trends in participant confusion and transformed those insights into an education strategy that saved time, money, and frustration.

The Problem: Repeat Escalations, Denied Claims, and Forfeitures

Participants were consistently submitting claims for ineligible expenses or outside the eligible time period. This led to:

-

High rates of forfeiture (participants losing funds)

-

Denied claims requiring manual appeals

-

Frustrated participants escalating their issues

-

Increased workload for Customer Service, Compliance, and Claims teams

Rather than handling these issues reactively, we decided to dig into the root causes.

The Analysis: Finding the Patterns

Using Excel and Python, I analyzed several months of cases flagged as “Participant Error.”

Variables analyzed:

-

Plan type (HSA, FSA, DCA, etc.)

-

Timing of the claim (e.g., before coverage start)

-

Participant account status (active, terminated)

-

Appeal outcomes

-

Repeated escalations by the same individuals

What We Discovered

Some of the most common patterns included:

-

Misunderstanding of eligible expenses (especially dental vs. medical)

-

Confusion about coverage periods after termination

-

Repeated errors by participants who were never properly onboarded

-

High volumes of claims submitted just after plan year rollover

We visualized this in Python using bar and pie charts to show:

-

Most common types of errors

-

Percent of errors by plan type

-

Number of escalations prevented after education intervention

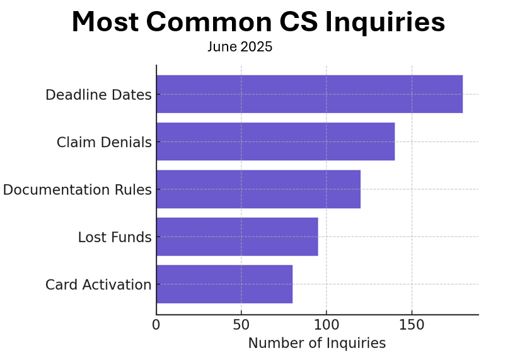

Data Visual (Mockup)

This bar chart highlighted the most frequent misunderstandings, which helped prioritize our education efforts.

The Solution: Data-Driven Education

We designed a multi-tiered education approach based on our findings:

-

Pre-enrollment emails highlighting top confusion areas

-

Onboarding sessions focused on plan differences and timing

-

Updated claim instructions with visual guides

-

Short videos answering the “top 5” participant questions

-

Monthly “learning labs” for internal support teams to strengthen their knowledge

The Outcome

-

40% reduction in repeat errors within one quarter

-

Increase in successful claim submissions

-

Fewer escalations to the Compliance team

-

Improved participant satisfaction in post-interaction surveys

Key Takeaway: Education is a Compliance Tool

Participant errors aren’t just a nuisance; they’re a signal. By treating them as data points, you can design smarter education, streamline operations, and protect both your participants and your organization.